So many crypto projects have emerged with lots of hype and expectations around them, only to fizzle out when the investors and early contributors prematurely pulled out their crypto tokens after cashing in on the project.

The investors do this because they never really believed in the crypto project. So, they coyly pumped funds into it and waited for the right time to withdraw all their tokens with added profits, effectively paralyzing the crypto initiative and causing it to sink to the dismay of the founders.

Luckily, creators of new crypto projects have developed a technique to curb this unethical development. It’s a strategy adopted from traditional finance into DeFi projects to ensure that investors, team members, founders, and early contributors are involved and committed to a crypto project till the end.

Token Vesting Explained

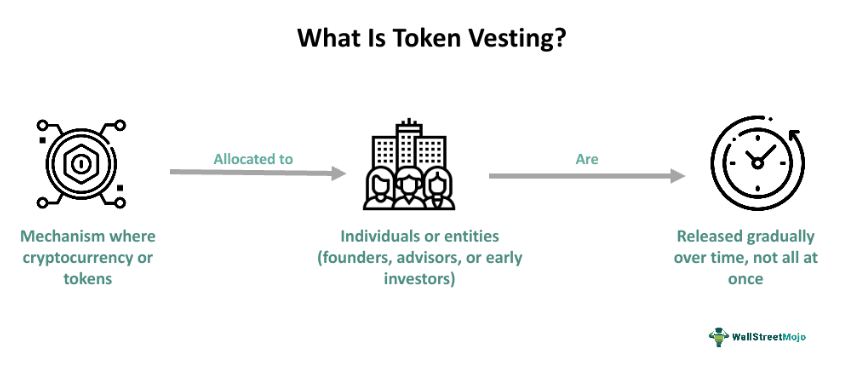

To guarantee the commitment of everyone involved in a crypto project, from the creators to the investors, the concept of token vesting was introduced.

Token vesting is a method of regulating how tokens will be distributed over time. Most founders of a crypto coin use smart contracts to release tokens over a fixed period of time as some conditions are met. Think of token vesting as a time-released safe that secures crypto coins and other digital assets.

Source: https://www.wallstreetmojo.com/token-vesting/

It ensures that investors get their tokens at different points as time goes on, fostering their continued dedication to see the project through to the end. Team members of the crypto project are incentivized to work on the project since their tokens are currently locked and will be released installmentally over a period of time.

Safeguarding crypto projects during launch with vested tokens significantly boosts its chances of success. Token vesting is also a measure to prevent market flooding, which could cause the tokens to depreciate in value instantly.

When a team launches a project, one of the things that attracts investors toward that project is the presence of vested tokens. They look out for this because it represents stability.

Token vesting also screams trust because it shows that the entire team is confident in their ability to work long-term to achieve success with the project. It proves that those behind the project aren’t in it for the momentary gains.

Trust is a big deal in the cryptocurrency industry, knowing how new crypto projects sprout up one moment and are gone the next moment. Vested token allays the fears of those funding the project because everyone would be enthusiastic about working on the project to receive small amounts of tokens over a fixed period of time.

Types of Token Vesting Schedules

Several vesting schedules exist to cater to the different demands of crypto projects. There’s no single type of token vesting that’s suitable for every crypto initiative.

Choosing the correct vesting schedule will register the desired imprint on the minds of team members and investors. Let’s dive into some of the typical vesting schedules.

Time-Based Vesting

In time-based vesting, tokens are distributed at regular time intervals such as monthly or annually. The only condition for tokens to be released is when a predetermined period of time has elapsed.

Ethereum used this vesting schedule in 2014 to distribute coins over a period of 42 days.

Milestone-Based Vesting

For a milestone-based vesting schedule, tokens are only released when specific project milestones are met. These milestones could range from anything like introducing a new feature to completing a user count objective. An example of this is how Aptos started releasing a portion of tokens after the launch of Mainnet.

Hybrid Vesting

Hybrid vesting strategically combines time-based and milestone-based vesting into a single vesting schedule. Tokens are gradually released whenever a preset time period completes its cycle while making room for the possibility of earning extra tokens whenever a specified milestone is completed.

Linear Vesting

A linear vesting schedule follows a straightforward release of tokens in equal amounts over a preconfigured period of time. The duration of the preset period of time could be anywhere from a few hours to a couple of years.

A linear vesting schedule could be set to release 15% of tokens every six months, 20% of tokens every year, or even 0.5% of tokens every 48 hours.

Graded Vesting

Graded vesting slightly differs from linear vesting because the crypto company customizes increasing amounts of tokens to be distributed over fixed periods of time.

Unlike linear vesting, a company could program 5% of tokens to be released in the first year, 10% of tokens to be released in the second year, and 15% of tokens to be distributed in the third year. It’ll keep progressing like that throughout the years until all the tokens are fully unlocked.

Cliff Vesting

Founders of crypto projects use cliff vesting as a more radicalized approach to hold investors’ interest for a long time. In cliff vesting, investors are prohibited from accessing any tokens at the launch of a crypto project for a time known as the cliff period.

After the cliff period is over, then bulk tokens are suddenly released to the investors. Either that, or the founders of the crypto project could subscribe the investors to a graded vesting schedule, time-based vesting schedule, or any predefined vesting schedule already in place.

Twisted Vesting

A twisted vesting schedule is a random distribution of crypto tokens over a predetermined period of time. Any amount of token can be released at hourly, weekly, monthly, or yearly intervals.

Reverse Vesting

In a reverse vesting schedule, tokens are allocated upfront to all participants but will be taken back if these investors and participants fail to meet certain conditions. As long as users satisfy the spelled-out conditions, they get to keep the tokens to themselves.

Also, if any team member in the crypto initiative backs out of the project prematurely, the reverse vesting schedule will ensure that they forfeit their tokens.

How Token Vesting Works

Token vesting guarantees that the market for a crypto project remains stable, and at the same time, it shoots up the project’s lifespan. All of these are bound to attract early investors who seek to gain considerable shares in the budding crypto project.

Knowing this, founders of a crypto initiative begin token vesting by first choosing the vesting schedule for early investors, team members, and participants of the project. The vesting schedule will clearly highlight when and how tokens will be distributed. The vesting schedule is programmed into a smart contract so that tokens will be released automatically as conditions are met.

The timetable of the vesting schedule will be included in the project’s whitepaper, constituting an important part of its tokenomics to foster transparency between all stakeholders.

A cliff period will then be then be established. It’ll be a time period ranging from a few months to some years when no tokens will be delivered to investors. The cliff period is set in place as a test of the team’s dedication, making sure that only devoted members benefit from the project. All others who pull out of the project prematurely will lose their tokens.

Once the cliff period comes to an end, the vesting period will be kickstarted. At this time, the chosen vesting schedule such as time-based vesting, graded vesting, or any other type of vesting schedule will be set in motion.

Tokens will be released to investors and members of the project depending on the type of vesting schedule that was selected. The smart contract begins to award tokens to investors and everyone involved in the project as stipulated periods of time go by and predetermined milestones are met.

Final Thoughts

Efforts to make sure early investors and team members continue to work on crypto projects till they achieve success necessitated the development of token vesting. Smart contracts are then used to automatically regulate the distribution of tokens among stakeholders.